The insurance sector is now undergoing a lot of changes due to technological advancements and digital transformation. Heavy competition forces insurance agencies to serve customers in more flexible ways. Customers are also expecting hassle-free services from insurance agencies, so insurance agencies wish to go for Salesforce CRM.

Salesforce for insurance

Salesforce is technically the #1 CRM solution that is ideal for insurance-based businesses. Most insurance companies are now leveraging the features of Salesforce to enhance and increase their productivity, drive revenue, streamline business processes, and close more deals consistently. Salesforce also helps insurance reps to make the right decisions rapidly. Salesforce insurance CRM can be the best-suited tool to manage policyholders and insurance reps without trouble. Insurance agencies are operating slightly different from other companies, but CRM embracement makes everything simple and hassle-free.

Is Salesforce embracement working great for insurance companies? Yes of course, it helps insurance agencies to attract new customers and engage existing ones consistently.

SCHEDULE MY CUSTOM CONSULTATION

By partnering with QRS, you can enjoy the full potential Salesforce services without any worries. Click here to speak with our experts.

Reasons to choose Salesforce Sales cloud for insurance

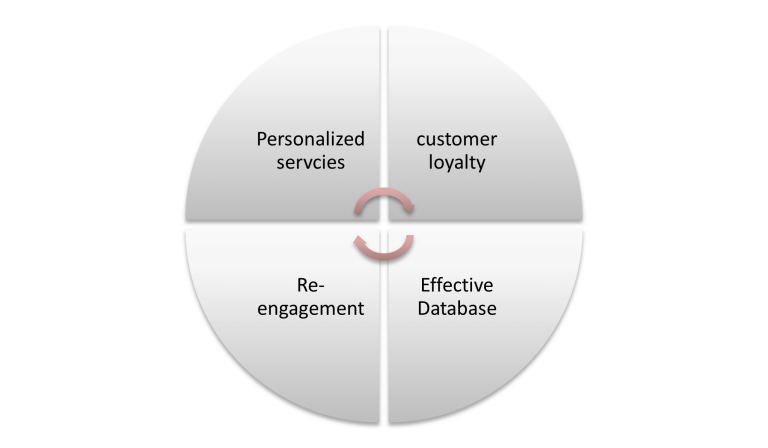

Personalized services

Salesforce insurance solution helps insurance companies to increase potential customers and understand existing customers. CRM also activates users to provide personalized services according to customer requirements. Salesforce financial service cloud paves way for marketing automation features, which enables agencies to nurture leads and then turn valuable leads into customers. Salesforce CRM for insurance is ensuring personalized services to policyholders, but insurance companies need to partner with a skilled Salesforce implementation partner.

Customer Loyalty

Offering exceptional customer service is the best way of improving the loyalty of customers. Insurance agencies that have embraced Salesforce CRM get access to crucial insights. Salesforce CRM can integrate with different sections such as marketing, sales, admin, and more. Salesforce also allows insurance staff and policyholders to connect digitally. Salesforce helps insurance agencies to provide improved customer service to all clients, so customer loyalty will have a chance to be improved.

Effective database management

Salesforce is a cloud-based CRM solution, so it can store and merge tons of data such as policyholder names, policy details, contact numbers, policy renewals, transaction history, and more. All these data can be displayed in one single dashboard. Insurance reps can get any data of clients from any location through mobile phones or laptops. Security is the big feature of Salesforce so insurance companies can prevent unauthorized access easily.

Secure repeat business

Salesforce CRM can be used to bring people together, data silos, and provide a 360-degree view of customers. This allows insurance reps to sell more while making repeat sales to engaged customers. Customer re-engagement is the success of Salesforce CRM and insurance company embracing. Insurance reps can close deals quickly when they do business with existing clients.

Wrapping up

Salesforce CRM for insurance provides insurance agencies with an excellent opportunity to serve and support their customers digitally and quickly. Today, insurance agencies are growing enormously because of Salesforce’s embracement. It manages all the processes of insurance companies so both customers and companies are happy today.

TO CLOSE MORE DEALS FASTER

QRS have a team of powerful Salesforce experts to set up Salesforce solution for insurance. Want to connect your insurance agency with your clients? Contact us to avoid complications.